Expert Knowledge. Honest service.

Great value.

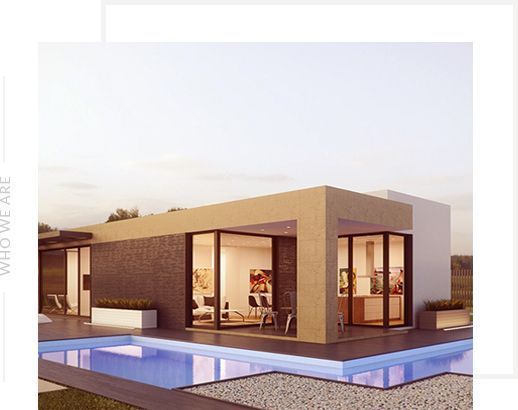

Welcome to

OB CONVEYANCING

THE GREAT CONVEYANCING EXPERIENCE

Buying or selling property is one of the most important transactions of a person’s life. It can be an overwhelming experience as there are so many things that need to be considered.

Most people do not deal with an estate agent, banker/broker or financial institution on a regular basis. Therefore, apart from having to adjust to this experience, there is also an enormous amount of legal regulations, processes and vocabulary to which a buyer and seller must become very familiar with.

One of the tasks of a conveyancer is to assist the client through this new experience, and as well as attending to the technical requirements of the conveyance, to ensure the client (you) is comfortable throughout the entirety of the property transaction process.

OB Conveyancing is a specialised licensed conveyancing business that is fully dedicated to assist clients in all aspects of conveyancing, such as buying, selling, transferring or subdividing within Victoria.

Call us today:

03 9700 1292

OUR SERVICES

2 years ago

Wow! We now have 100 5-star reviews.

Thank you to all of the exceptional customers who have taken the time to share their positive experiences

We sincerely appreciate it and value your supoort greatly.

OB Conveyancing. ...

OB Conveyancing is feeling blessed.

3 years ago

4 years ago

The State Revenue Office has published comprehensive HomeBuilder Guidelines detailing eligibility criteria and the evidence needed to support an application.

The State Revenue Office is currently building an online portal that will allow applications to be lodged for the Grant.

You can register to receive email updates by accessing the below link

www.sro.vic.gov.au/subscribe-homebuilder-updates

www.sro.vic.gov.au/homebuilder-grant-guidelines?fbclid=IwAR1Ns71H5kK0K8e4Jo5IGTdUuD6QHnIxzUZM6_NS... ...

HomeBuilder Grant guidelines | State Revenue Office

www.sro.vic.gov.au

HomeBuilder provides eligible owner occupiers with a grant of $25,000 to build a new home, substantially renovate an existing home or buy an off-the-plan home/new home. A new home is one that has not previously been sold or occupied as a place of residence (e.g. a spec build) and where construction....4 years ago

On 4th June the Federal Treasurer announced the Home Builder grant of $25,000 available to eligible owner-occupiers (including first home buyers) to build a new home or substantially renovate an existing home.

The criteria for eligibility include :

• the applicant is a natural person, over 18 years of age and an Australian citizen;

• they meet one of the following two income caps

- $125,000 p.a. for an individual applicant based on their 2018-19 tax return; or

- $200,000 p.a. for a couple based on both 2018-19 tax returns.

• They entered into a building contract between 4th June 2020 and 31st December 2020 to either: build a new home as a principal place of residence, where the property (house and land) does not exceed $750,000; or carry out renovations within a price range of not less than $150,000 or more than $750,000.

• Construction must commence within 3 months of the contract date.

Each State and Territory is required to sign the National Partnership Agreement (NPA) with the Commonwealth Government. The scheme for Victoria will then be administered by the State Revenue Office (SRO).

We understand that the SRO is not yet in a position to provide information on the scheme or its administration but has established an internal working group in readiness to progress the administration of the grant program as soon as it is able to do so.

More information can be found in the below link

www.sro.vic.gov.au/news/homebuilder-grants-eligible-owner-occupiers ...

HomeBuilder grants for eligible owner-occupiers | State Revenue Office

www.sro.vic.gov.au

The Australian Government’s HomeBuilder program provides eligible owner-occupiers, including first home buyers, with a grant of $25,000 to build a new home or substantially renovate an existing home. The State Revenue Office will administer the HomeBuilder program in Victoria on behalf of the Aust...4 years ago

For some time, the Federal Government has proposed a crackdown on illegal phoenixing activities. "Phoenixing" occurs where Directors of a Company deliberately avoid paying liabilities by shutting down an indebted company and transferring assets to another company.

Part of the reforms include the introduction of a requirement for all Company Directors to hold a unique identification number. The reform will now go forward following the passing through both houses of Federal Parliament of the Treasury Laws Amendment (Registries Modernisation & Other Measures) Bill 2019.

All registry functions will be transferred to a single Commonwealth Business Registrar.

Amendments have been made to the Corporations Act which will require all current Directors and persons who are to be appointed as Directors to obtain a Director Identification Number (DIN). Once issued with a DIN, that number will be retained by that person, even if they subsequently cease to be a Director.

Civil and Criminal Penalties will apply if Directors do not comply with the Act.

The new regime was anticipated to commence in the first half of 2021. However, due to the current pandemic, it is now expected to commence in 2022. ...

OB Conveyancing Pty Ltd

Licenced Conveyancer 001678L